Understanding “What does your credit score start at?” is an important first step when you’re starting to use credit. When you first enter the credit system, you don’t start with a credit score at all. You are considered ‘credit invisible‘. You remain this way until your first credit activity.

Once you do, your initial credit score will be determined. But what is this starting score, and how is it calculated?

In this guide, we will delve into the concept of a “starting credit score” in the UK. Also, debunk common myths and explore what influences this initial score.

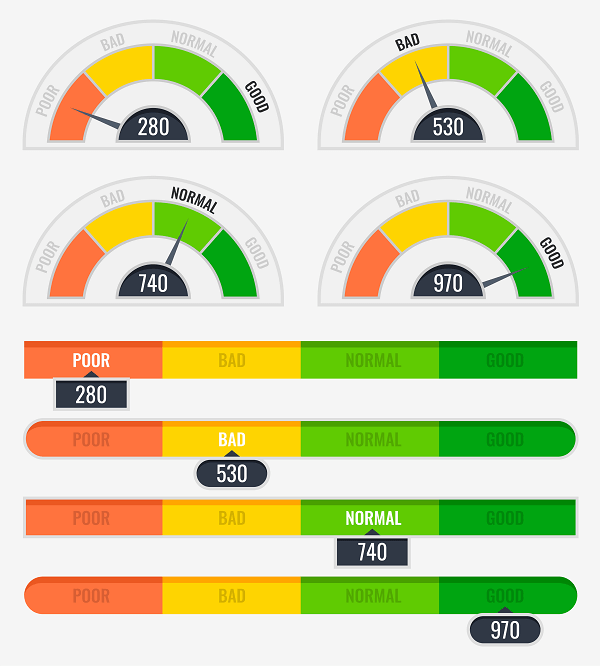

In the UK, credit scores range from:

- 0-999 for Experian

- 0-1000 for Equifax

- 0-710 for TransUnion

Your credit score will start somewhere in between. When you begin using credit, like credit cards, or loans, you’ll get a starting credit score.

Lenders share your first credit account activity with the credit reference agencies. These are Experian, Equifax, and TransUnion. All this will be reported in a credit file. This credit file is then used to determine your starting credit score.

Here are the lowest scores used by the major agencies:

- Experian: The lowest credit score possible is 0.

- Equifax: The lowest credit score possible is 0.

- TransUnion: The lowest credit score possible is 0.

Unless you have recent trouble with on-time payments, your average credit score won’t start that low.

Table of Contents

Does everyone start with the same credit score?

No, not everyone starts with the same credit score. Credit scores are based on a person’s financial habits. Each person begins with no credit score. It is established as they start using credit. This means that your starting score depends on what your first financial actions are.

Factors that influence the credit score:

- Payment history

- Credit usage

- Length of credit history

- Types of credit used

- Recent credit applications

Factors like payment history and length of credit history will not be present on your starting credit score. However, these credit scores can improve as such information is added. Poor financial choices or negative information can lower your scores. Thus, credit scores can vary among individuals based on their financial habits and history.

What does it mean to be credit invisible?

Credit invisible refers to individuals who have no established credit history. It means that there is not enough information available about their borrowing and repayment habits. This can cause difficulty to credit reporting agencies to generate a credit score.

This situation often occurs with young adults who have just entered the financial system.

What impacts a starting credit score?

Credit history

The length of your credit history plays a role in determining your credit score. Starting out, you may have a shorter credit history, which can impact your score. Generally, a longer credit history with responsible credit management demonstrates stability. This can positively affect your score.

Payment history

Your payment history has a significant impact on your credit score. Making all your payments on time and in full is crucial for establishing a positive credit history. Late payments or defaults can lower your score when you are starting out.

Credit usage

Credit usage refers to the amount of credit you use compared to your available credit limit. Keeping your credit usage low, ideally below 30%, is advisable. High credit usage can indicate a higher risk of overborrowing. And may negatively impact your starting credit score.

Types of credit used

A mix of different types of credit can positively influence your starting credit score. Having a combination of revolving credit (e.g., credit cards) and instalment loans (e.g., auto loans, student loans) demonstrates responsible handling of various credit types.

New credit applications

When you apply for credit, it generates a “hard inquiry” on your report. Multiple hard inquiries in a short period can lower your credit score. It suggests a higher credit risk. Be cautious about applying for too much new credit when starting out.

Public records and negative marks

Negative information can significantly impact your credit score. This includes bankruptcies, foreclosures, or collections. You may not have such negative marks starting out. It’s crucial to maintain responsible financial habits to avoid these negative impacts in the future.

It’s important to note that credit scoring models can vary, and different models may weigh these factors differently. It’s advisable to focus on building a positive credit history. Do this by making payments on time. Using credit responsibly. And keeping balances low to establish a good starting credit score.

Understanding Credit Score Ranges in the UK

In the UK, credit scores typically range from 0 to 999. The range varies slightly depending on the credit reference agency. For example, Experian scores range from 0-999, Equifax from 0-1,000, and TransUnion from 0-710. The higher the score, the better your creditworthiness is.

Defining a good credit score

In the UK, a good credit score is generally considered to be in the range of 881 to 960 (for Experian). 531 to 810 (for Equifax). And 604 to 627 (for TransUnion). However, different lenders may have different criteria for what they consider good credit score.

The importance of aiming for a good credit score

Having a good credit score can open up a variety of financial opportunities. It can make it easier to get approved for credit cards and loans with better terms and lower interest rates. It can also impact other areas of your life. This includes your ability to rent or even get certain jobs.

Tips to help build your starting credit

Open a bank account:

Start by opening a checking or savings account in your name. This establishes a financial relationship.

Obtain a secured credit card:

Secured credit cards are designed for people with limited credit history. They require a cash deposit asset, which becomes your credit limit. Use the card responsibly. Make small purchases and pay off the balance in each month. This helps establish a positive payment history.

Become an authorised user:

Ask a family member with a good credit history to add you as an authorized user on a credit card. Their positive credit habits will be reflected on your credit report, boosting your credit profile.

Apply for a credit-builder loan:

Some financial institutions offer credit-builder loans. These are designed to help individuals build credit. These loans require you to make regular payments. The payments are reported to the credit bureaus, helping establish a positive payment history.

Pay bills on time:

Consistently pay all your bills, such as rent, utilities, and loans, on time. These payments may not directly contribute to your credit score initially. They can be considered in alternative credit scoring models. Or when lenders manually review your creditworthiness.

Monitor your credit reports:

Regularly check your credit report. Do this from the major credit bureaus (Experian, TransUnion, and Equifax). This is to ensure accuracy and identify any errors or fraudulent activity.

Apply for a credit card or loan:

After building a positive credit history, consider applying for a regular, unsecured credit card. Start with lenders that serve people with limited credit history. You can also look for credit cards meant for beginners.

Credit score updates and monitoring

Credit scores are updated whenever new information is available for three credit bureaus. This can happen whenever lenders report your account information to the three major credit bureaus again. This is typically once a month.

Factors that can trigger a credit score update

Several factors for bad credit can trigger a credit score update. This includes making payments. Missing payment. Applying for new credit card accounts. Or having a change in your credit utilisation.

The importance of regular credit monitoring

Regular credit monitoring can help you keep track of changes to your credit score. And

also identify any potential errors or fraudulent activity. It can help you understand how your financial behaviours and good credit habits are impacting your credit score. And what you can do to improve it.

Conclusion

Understanding your starting credit score is a key step in taking control of your financial future. It forms the basis for using credit responsibly. It also empowers you to establish credit and make informed financial decisions. Your starting credit score is not a fixed number and is influenced by your initial credit activities.

Remember, your starting credit score is just the beginning of your credit journey. Continue to engage in responsible credit behaviours. And your score will improve over time, leading to better financial opportunities.

Frequently Asked Questions

What is a starting credit score?

A starting credit score in the UK is the first credit score a person who has completed 18 years of age has when they first enter the credit system. In the UK, credit scores can range from 0 to 1,000 depending on the credit reference agency.

How can I improve my starting credit score?

Improving your starting credit score in the UK involves responsible credit behaviour. This includes making payments on time. Keeping your credit utilisation low. Avoiding applying for new credit frequently. And regularly checking your credit report for errors.

How often should I check my credit score?

At a minimum, you should check your free credit score once a year. If you are actively working to improve your credit, you might want to check your score more frequently.

Disclaimer: The information given above is provided for information purpose only. This is not financial advice.