Quick Loans

Looking for quick loans for urgent financial needs? Lending Stream offers fast loans with instant decisions. If approved, money is sent to your bank in 90 seconds*. We’re FCA-authorised. We accept applications with bad credit. You can apply online in minutes. See if a quick loan from Lending Stream is right for you.

Not all applications will be approved for a loan. An offer of credit is subject to status and affordability checks.

What our customers are saying

Why Choose Lending Stream for Quick loans?

Representative 1271%APR

Lending Stream is FCA Authorised

At Lending Stream, we’ve been proudly helping customers in the UK since 2008. We’ve helped over half a million customers and lent over 3.5 million short term loans. We’re an FCA authorised and regulated direct lender. Our authorisation number is 689378. Responsible lending is our biggest priority. We want to ensure our customers a great experience.

To achieve this, we believe transparency is key. We want you to fully understand:

- The cost of your loan

- Any fees

- The repayment plan

At Lending Stream, we follow the Financial Conduct Authority (FCA) rules. This means charges, like interest rates and fees, are clear and upfront. No hidden costs, no surprises – everything is clear and easy to understand.

What are Quick Loans?

Quick loans are small, short term loans designed to help you cover urgent expenses. These loans are meant for situations where you need money fast, like unexpected bills, car repairs, or emergency expenses. You apply online, get an instant decision, and if approved, receive the funds in your bank account, often on the same day.

It’s important to remember: A quick or fast loan means the money is approved and sent to your account quickly. It doesn’t mean it’s a special type of loan. However, you should be cautious. Some lenders promoting quick loans or fast cash may have:

- Loans with very high interest rates

- No credit checks

- Very easy eligibility

While these loans can provide immediate funds, they may not be authorised and regulated by the FCA.

Quick Loans from a UK Direct Lender

Quick cash loans from direct lenders give you speed, control, and less hassle. At Lending Stream, we keep things simple. We provide quick decisions, and clear terms from the start. We offer easy access to quick loans for unexpected bills or expenses, if approved. And our process is fully online. We provide instant decision and same day payout for approved users.

Being a fast loans direct lender, we’re here when it counts. You deal with us directly. We are transparent about interest rates, fees, and your monthly repayments. That way you’re never in the dark.

That said, it’s important to borrow with caution. Missing or delaying payments can hurt your credit score. It can even make borrowing more difficult for you. Check the loan terms and costs before you apply. Only borrow if you are sure you can repay on time.

Lending Stream vs Other Quick Loan Direct Lenders

| Feature | Lending Stream | Other Quick Loan Direct Lenders |

|---|---|---|

| FCA authorised & regulated | Yes, we are an FCA authorised and regulated direct lender in the UK | You can check if a lender if FCA authorised by checking the Financial Services Register |

| Loan amounts | Our loans range from 50 to £800 for new customers and £100 to £1500 for existing customers | It varies between lenders |

| Repayment terms | 6 months with fixed monthly instalments | It varies between lenders |

| Payout Speed | Cash to bank within 90 seconds, if approved. It may take longer to reach your account depending on your bank’s processes | Exact timing varies between lenders |

| Upfront fees | No upfront fees will be asked | Varies – some may ask |

| Application process | 100% online. Available 24/7 | Varies, some may require phone or in-person applications |

Representative 1271%APR

Eligibility Criteria for Quick Loans With Lending Stream

If you are looking to check your eligibility to apply for a quick loan with Lending Stream, then you must:

- Have a valid debit card

- Have an active UK bank account

- Be a UK resident

- Be at least 18 years old

- Be in regular employment with a monthly income of at least £400

We may ask for proof of your income during the application process. As a responsible lender, we do this to ensure you can afford the repayments.

Representative 1271%APR

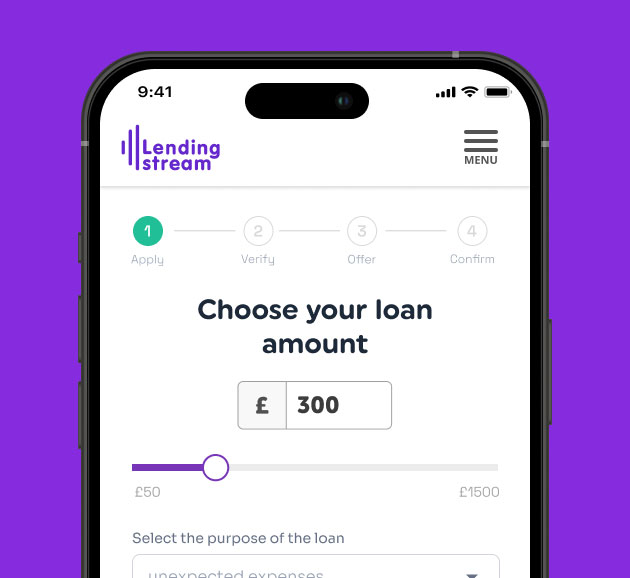

How to Apply for a Quick Loan With Lending Stream?

To apply with for a quick loan with Lending Stream, you’ll have to complete an online application form. You’ll be asked for the following details:

The amount you want to borrow with us

Some basic personal information

Your employment, salary, expenses, and banking details

After you apply, we’ll run a credit and affordability check. This helps ensure responsible lending and borrowing. We also check to see if you can afford the repayments. If approved, we’ll send the loan terms and agreement for you to review and sign. Once signed, we’ll send the approved loan amount to your bank within 90 seconds*.

We understand that credit scores don’t always represent your current financial situation. That’s why we consider loans for bad credit for people with a poor credit history.

Representative 1271%APR

How Do Quick Loans Work in the UK?

In the UK, quick loans are a type of small loan. They are designed to help you borrow money fast when you need it most. These loans are usually for smaller amounts. They’re repaid over a few weeks or months, depending on your loan term.

Some lenders (like Lending Stream) can send cash to your bank in minutes. This is, however, dependent on whether your application is approved.

Here’s how it works:

1. Application

Apply with an FCA authorised lender. The application is usually straightforward. You’ll need to share some personal and financial information.

2. Approval

Lenders assess your application quickly, within minutes or hours.

3.Loan terms

If you get a loan approval, you’ll receive a loan offer. This will include the loan amount, interest rate, fees, and repayment period.

4. Payment

If you agree to the terms the funds are typically sent quickly. At Lending Stream, we believe it’s important to do things quickly. We’ll send the cash to your UK bank in 90 seconds, if approved. This could be longer, depending on your bank’s processing.

5. Repayment period

It can vary but is generally short. At Lending Stream, we give you 6 months to repay the loan. We don’t charge early repayment fees. If you want to pay the loan early, you can!

6. Automatic repayment

Some lenders may set up automatic repayments. This uses something called ‘continuous payment authority’. This means the amount owed will be taken from your bank account on the due date.

Missed or late payments can have a negative effect on your credit score. Make sure you review the terms and costs of the loan.

Representative 1271%APR

“Quick loans are for people who need fast access to money for urgent expenses. You can apply online and get a quick decision. The loan can be with you the same day if approved. It’s important to read the key terms of the loan. The process is fast, but like any loan, it will still need to be repaid monthly. Make sure you can afford the repayments before you apply.”

Andrew Wayland

Loan Expert – Lending Stream

What are Quick Loans Typically Used For?

Emergency Expenses

Life can be unpredictable. Quick loans help cover emergency costs. This could include:

- Unexpected bills

- Sudden repairs

- Urgent private dental costs

These situations can’t wait. Same day payouts make sure you get help when you need it.

Rent or Utility Payments

Sometimes, emergencies lead to cash flow issues. If you need to pay rent or utility bills to avoid late fees or disconnection, a quick loan can help bridge the gap. These should not be seen as a regular solution, though.

Home Improvements

Sometimes things break when you least expect it. A fast loan can help pay for small home fixes like boiler repairs or emergency plumbing. It’s a quick solution when you don’t have savings but need to act fast.

Car Repairs

Your car breaking down can throw your whole week off. Whether it’s a flat tyre or any other repair, quick loans give you fast access to the funds needed to get back on the road without long delays.

Bridge Financial Gaps

Sometimes, cash flow can lead to a temporary gap between expenses and income. In these cases, a quick loan might help you smooth things over. You can handle essential costs and repay in easy monthly repayments.

How Much Can I Borrow With a Fast or Quick Loan?

When you apply for a quick loan from Lending Stream, new customers can borrow between £50 to £800. Existing customers can borrow £100 to £1,500. A fast loan can range in amount, but you’ll need to show you can afford to make repayments. As a responsible lender, we’ll only lend if we believe you can afford it.

We assess your loan application based on your personal circumstances, not just your past. Even if you’ve had bad credit, we may still be able to help. Every approved customer receives a clear loan agreement, showing how much you can borrow and what it will cost.

How Does the Loan Repayment Work?

Repayment of loans in the UK depends on the type of lender you choose. At Lending Stream, our loans come with repayment period of 6 months, split into fixed monthly instalments. You can also repay your loan early at any time, with no extra fees or penalties. Before taking out a loan, it’s important to carefully review the repayment terms and make sure the loan is affordable. Missing payments can lead to additional charges and negatively impact your credit score.

If you’re struggling to keep up with repayments, support is available from free and independent organisations:

StepChange Debt Charity – Free, confidential advice tailored to your financial situation.

National Debtline – Offers independent guidance by phone or online.

Citizens Advice – Local and online support covering debt, benefits, and legal rights.

Can I Get a Quick Loan with Bad Credit?

Yes, it is possible to get a quick loan with bad credit history. Some lenders offering quick loans can be more willing to consider applicants with a bad credit score. At Lending Stream, we understand that many people applying for loans have had bad credit or a poor credit history. That doesn’t mean you’ll be turned away.

We assess your full credit file, income, and personal circumstances to see if a loan is affordable for you. We don’t rely on your credit score alone. Our goal is to support people through temporary financial difficulties with fair options and flexible terms.

What Should I Do If My Quick Loan Application is Not Approved?

If your loan application is declined, it can be tempting to apply again and again until you get approved. However, multiple applications in a short period of time can negatively affect your credit score.

Instead, you can:

Contact the lender

Ask if there are any specific reasons for the decline. This feedback can provide valuable insights into areas you need to work on before reapplying. The lender can also provide you with the details of the credit reference agency they used.

Assess your financial situation

Are there areas that need improvement? Have you taken steps to enhance your credit score or income? Taking proactive measures can strengthen your application the next time around.

It’s also worth finding out if there are benefits, you’re entitled to that you’re not using. You can find out by using our BenefitGlance tool over at afforda.co.uk.

What are the Advantages of Quick Loans?

- Quick access to funds: As the name suggests, quick loans provide fast access to loan funds. This can make them ideal for urgent financial needs like unexpected expenses or emergencies.

- Simple application process: The application process for fast personal loans is usually straightforward. You don’t need paperwork or long forms, just fill in your details, and the online lender do the rest. This can be convenient and time-saving.

- Flexible use: You can use the loan money for urgent money problems such as unexpected bills, car repairs, or emergency expenses. The choice is yours, based on what you need most. · No collateral needed: Quick loans are also known as unsecured loans. This means that you won’t be asked for any security or assets. You don’t need to put up collateral (like your house or car) to get the loan.

- Potential for bad credit approval: Lenders like Lending Stream consider applicants even with a bad credit rating. We don’t rely on your credit report alone. Our goal is to support people through temporary financial difficulties with fair options and flexible terms.

- Affordable monthly repayments: With Lending Stream, you’ll have 6 months to repay. This is where we are different from payday loans lenders where you will need to pay the borrowed amount on your next payday.

What are the Disadvantages of Quick Loans?

- High interest rates: Because these are short term loans, the interest rates are often higher than those for traditional personal loans. Higher interest rates can make them more expensive to repay.

- Risk of impulse borrowing: The ease of obtaining these loans might lead to impulse borrowing. It’s important to only take a loan when you have considered your options. Only borrow the amount which you think you can repay easily.

- Fewer direct lenders: With regulation changes in the last decade, a lot of lenders are no longer around. But don’t worry, Lending Stream is still here and still lending!

FAQs – Quick Loans

What is a Fast Loan?

A fast loan is a type of quick loan. It gives you money fast, sometimes on the same day if approved. These loans work well for urgent costs like bills or car repairs. You apply online

and get an instant decision. Before you agree, you will see the monthly repayments, the representative APR, and the interest rates in clear detail.

Can I Get Quick Loans on the Same Day?

Yes, it’s possible to get a quick loan on the same day. When you apply for a loan online, many lenders (including Lending Stream) offer same day loans. They aim to send the money to your bank account on the same day.

Can I Get Quick Loans With No Credit Check?

Most FCA-registered companies conduct credit checks as part of their standard procedures. However, it is not a mandatory requirement. The decision to perform a credit check depends on the services provided and the company’s policies.

Do Quick Loans Affect Credit Scores?

Yes, quick loans can affect your credit score. Paying on time may help improve your credit rating, but missed or late repayments can lower it. Lenders report to major credit reference agencies. It’s important to manage your loan repayments properly to keep your credit history in good shape.

Can I Get A Quick Loan For My Business?

Yes, you may borrow, but not with Lending Stream. We only offer loans for personal use. Our loans are not meant for business expenses or commercial use. If you need to borrow for a business, you should look at lenders who provide business loan options made for that purpose.

Related guides

3 minutes read

3 minutes read

3 minutes read